80% NOL Limitation: The New Paradigm

In 2017, the Tax Cuts and Jobs Act (TCJA) rewrote U.S. tax law, sending taxpayers and tax professionals scrambling to understand the new legislation. The Act included a provision limiting net operating losses (NOL) incurred after Dec. 31, 2017, to 80% of taxable income rather than the historical 100%. This change was overshadowed by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and eventually was delayed to tax years beginning after Dec. 31, 2020.

While some taxpayers encountered this issue during their 2021 tax return filing process, the rule will become increasingly important going forward as it interacts with other expiring tax provisions.

How It Works

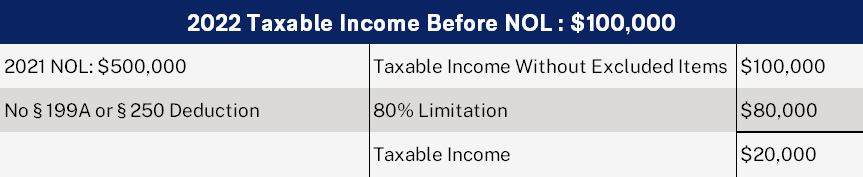

The rules state that the amount of the NOL is limited to 80% of the excess of taxable income without respect to any § 199A (QBI), § 250 (GILTI), or the NOL. For example:

In this example, tax is paid on $20,000 of income even though there was an NOL carryover more than the current year’s income.

Why It Matters

The importance of this new rule cannot be understated. If not considered, it can create surprises and cost cash. For example, a corporation was formed in 2020 to develop a mobile application. In 2020 and 2021 the company incurred losses. In 2022, it has taxable income. Even though the company has cumulative losses life-to-date, the company will pay tax.

This is only a temporary difference assuming a company continues to make money and will ultimately use the NOL. However, it can create a cash crunch and is something that can be mitigated with proper tax planning.

Is It Really That Complicated?

Taxpayers may think, “This is bad, but it seems relatively straightforward.” Maybe not as several other changes are on the horizon that might make tax planning more complex, such as:

- The 163(j) limitation being based on EBIT rather than EBITDA

- Phasing out of bonus depreciation beginning in 2023

- Mandatory capitalization of Research and Development (section 174) Expenditures (This will be especially impactful for start-up companies as in the example above.)

Considering these moving pieces and parts, taxpayers and tax professionals may need to be more in sync with one other. Modeling may be required three to five years out in order to optimize the cash taxes paid over that period. When modeling, taxpayers will have to consider how pulling different levers may impact the forecast. The scenarios below show how a taxpayer electing out of bonus depreciation and electing to capitalize and then later deduct prepaids that meet the 12-month rule could impact the tax owed.1

Note: In each of the following scenarios there are no operational or changes to the company’s internal books. These are tax return decisions that lead to significantly different outcomes.

For simplicity purposes, we have not considered 163(j), addition of assets in later years, or the impact to state taxes. Factoring in state taxes, for example, could have a significant impact on the analysis, especially in a consolidated C corporation with separate and consolidated filings It’s also important to note that we have demonstrated this in the context of a C corporation. However, this also has application to pass-through entities and individuals.

What’s Next

Being proactive is critical. With so many tax-related changes coming down the pike, businesses should work closely with their tax professionals to map out goals and forecasts as early as possible. These early conversations not only allow tax professionals to be proactive on clients’ behalves, they allow businesses to better understand future tax payments. Please reach out to your KSM advisor if you have any questions, or complete this form.

1 See Treas. Reg. § 1.263(a)-4(f).

Related Content

We're Looking for

Remarkable People

At KSM, you’ll be encouraged to find your purpose, exercise your creativity, and drive innovation forward.